Introduction

At MarketLauncher (ML), we regularly listen to the Voice of our Customers by conducting Client Quality Assessments (CQAs). CQAs give us a front-row seat to learn directly from our past, present, and even future customers.

With the current economic climate, we designed this year’s outreach to help us understand the challenges affecting our clients’ ability to sell and what strategies they are implementing in response.

We are very grateful to our participants who shared a wealth of intel. Their feedback allows us to understand market conditions so that we can help clients navigate through current challenges. It also helps us develop more valuable thought leadership materials and remain the “Experts You Can Trust.”

This document contains the results of the CQAs conducted earlier this year and select quotes from participants. We will continue our current CQA strategy over the remainder of 2023. Be sure to follow us on LinkedIn or sign up so you don’t miss our updates.

“ML’s Voice of the Customer services provide an opportunity for you to understand what is most important to your clients and ensure that your business is providing real value. Customer insights will validate your assumptions and help you focus on those areas of most benefit and the most profitable.

“CQAs can also provide value to your clients and improve their satisfaction. Incorporating validated needs and wants into your planning will result in an improved product or service that better supports their businesses.”

Michelle Haarde Senior Vice President of Account Strategy

Project Overview

The first phase of our 2023 CQA ran from January to March. Our goal was to understand the challenges affecting our clients’ ability to sell and what strategies they are implementing in response. The collected intel will be used to improve our services and develop more valuable thought leadership.

The survey process involved:

- Selecting a representative cross-industry sample of our clients, including past, current, and prospective.

- Preparing survey questions to capture both qualitative and quantitative data.

- Implementing personalized outreach to position the project, obtain participation acceptance, and schedule time for a LIVE interview by phone (versus having them complete an electronic survey).

- Analyzing the data collected to understand trends so that we can then act on the findings (including client-specific questions or requests that were generated from the process).

- Reporting the data to company leadership and implementing changes that the findings support.

“We have found that interviews conducted by phone rather than through an electronic survey result in a much higher completion rate. Speaking directly to customers provides a way to probe responses and get a more robust view of their perceptions.

“A two-way interaction is also a more positive customer service-oriented approach than a sterile one-way interaction with an electronic form.”

Mariana Loboguerrero Senior Market Research Specialist – Executive Interviewer

What Do You Perceive as the Biggest Challenges to Your Revenue Growth Goals This Year?

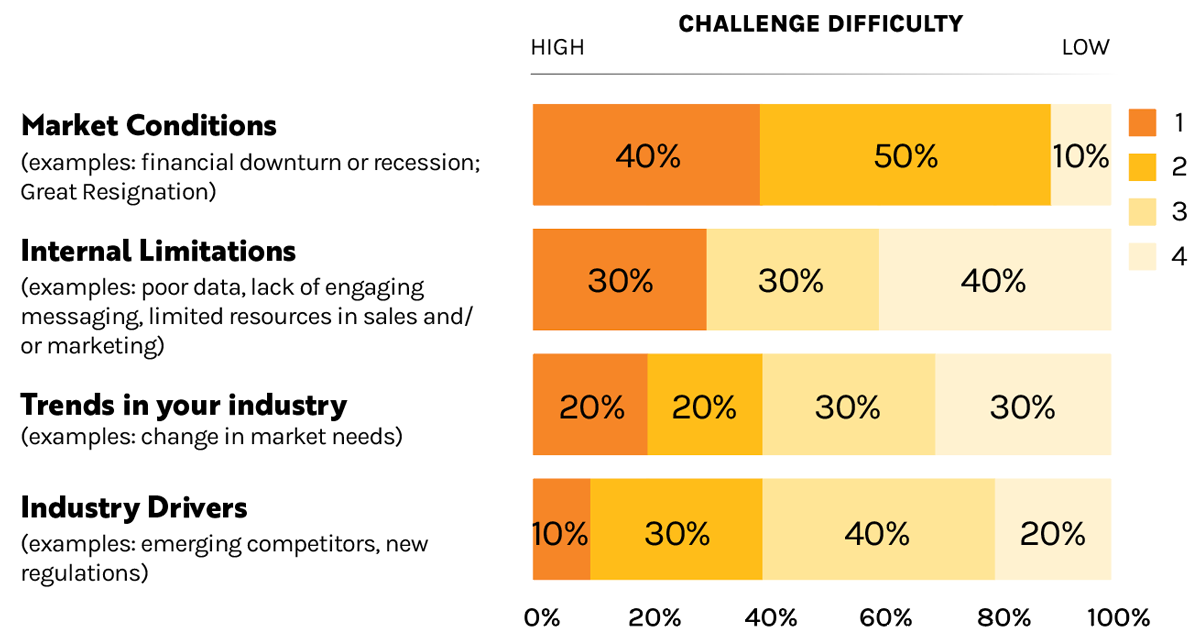

Respondents were asked to force rank their responses with #1 being the biggest challenge and #4 being the least.

90% ranked Market Conditions as their first or second top challenge to revenue growth. Internal Limitations were also cited, including lack of technology, shrinking access to capital, poor data, and people resources.

When we looked at these rankings by industry, we found that in Healthcare Internal Limitations outranked Market Conditions. In Manufacturing, Industry Trends were the number one challenge.

Looking at a broader industry sector breakout:

- In Business Services all respondents rated Market Conditions as the 1st or 2nd biggest challenge to revenue growth followed by two thirds citing Internal Limitations.

- In Software/IT, the responses were more diverse with 50% citing Market Conditions as the 1st or 2nd biggest challenge and 50% citing Industry Drivers. Internal Limitations ranked lowest for this sector.

Market Conditions

It was unsurprising to hear that Market Conditions are having the biggest impact on revenue growth. This confirms what we have been hearing directly from clients and prospects outside of this study, as well as our partners and peers.

Internal Limitations

Internal Limitations also ranked high and reflected multiple subjects ranging from a desire to improve product and services messaging, validate target markets, manage data, and fill technology gaps. Respondents are using this “slow” time to analyze the results of past sales and marketing processes. We then see they are acting on that analysis to remove barriers to success. They are taking time now to update their total addressable market data, understand competitors, review product roadmaps and better connect with their customers.

“Our number one challenge is rising above the competitive noise. The second is finding the right audience.”

Respondents are also struggling with limited sales and marketing resources. They cited two main reasons for the resource shortage:

- Decreased sales and marketing budgets; and

- An inability to find and hire the right individuals.

“For the most part, we’re a startup, so we’re raising money and we’re on a shoestring budget. Every penny counts. I hired a salesperson, but she didn’t work out. I also hired a customer success person and she quit because as a start-up I don’t offer the benefits that larger companies can. Retention is hard.”

***

“82% of my team, including myself, have been with the company less than a year or are new to their role. That’s a staggering number. Just the change process on personnel requires a lot of resources. Finding the right people, the recruitment process, getting the comp right, being flexible with what our view is… we have to be realistic for the current market conditions. These have an internal operational execution impact. Recovery and retooling my team have been the two biggest short-term impediments to growth.”

***

“[Data Analytics is] something that we have the skills for, we just don’t have the people right now. But it’s part of the hiring model if we are well enough funded. We would hire another sales analyst to be able to help narrow some of that down.”

Industry Trends and Drivers

Responses concerning Industry Trends and Drivers differed depending on the industry of our participants. Software/IT especially are challenged with these. Access to venture capital was mentioned as a serious threat affecting the ability to grow revenue, as was maintaining compliance with regulations.

“Since we are a government IT solutions provider, trends and emerging regulations are always our first concern.”

On a Scale of 1 To 5 Where Do You See Potential to Resolve Revenue Growth Challenges?

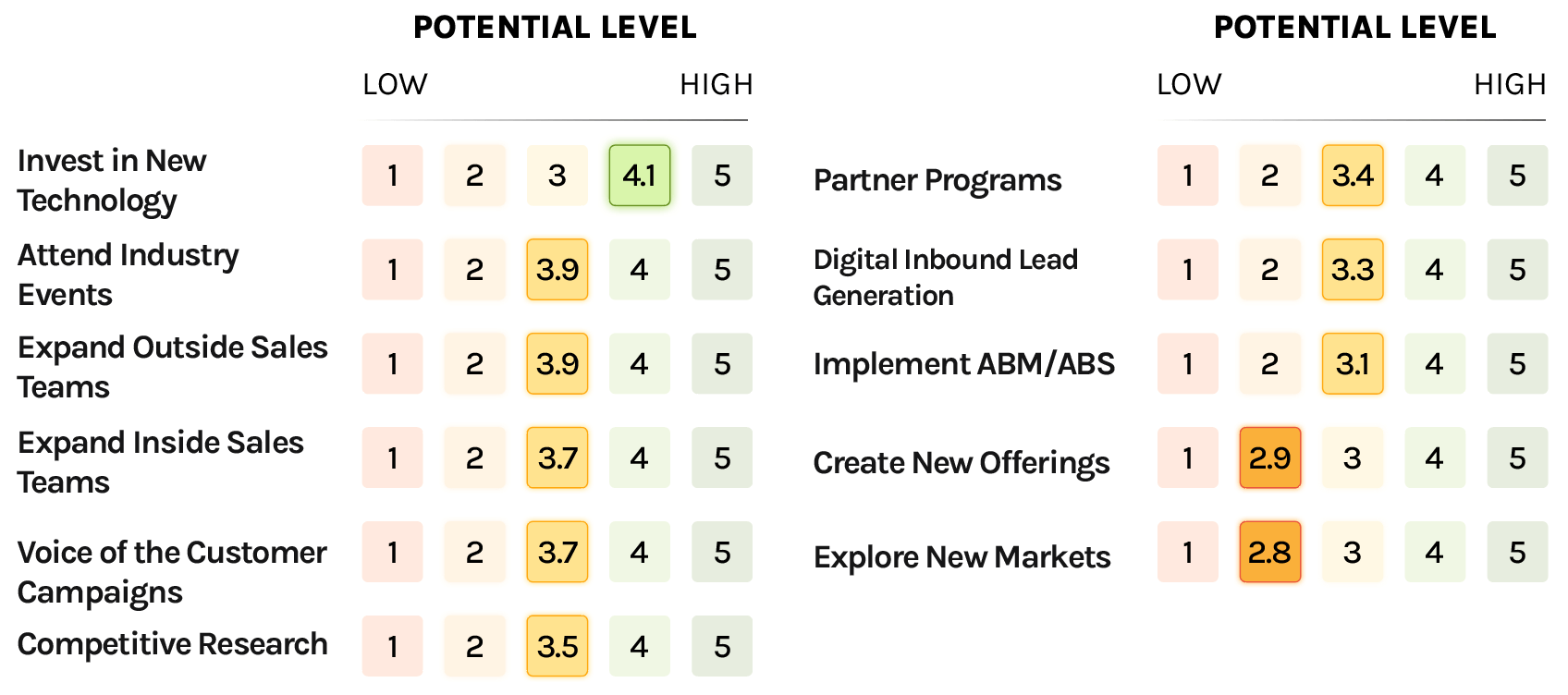

The results of this question showed a close race between Investing in New Technology, Attending Events, Expanding Sales Teams (inside and out), and implementing a Voice of the Customer Program (whether Win/Loss analysis, CQAs, or Market Research).

It is notable that Creating New Offerings and Exploring New Markets ranked as the lowest potential for revenue growth right now.

It’s also worth noting the results of Implementing Account Based Marketing (ABM) / Account Based Selling (ABS) which scored relatively low at 3.1. However, our analysis shows that many respondents have already implemented these programs and all of those said they plan to continue. This shows that ABM / ABS tactics are actually one of the top key strategies (whether continued or net new programs) participants are using to overcome their revenue growth challenges.

“We’re doing ABM right now. It’s very strategic. We are really focusing on our clients and going after where they want us to play. We’re not doing a big shotgun approach it is more of a laser focus on the ABM side.”

Looking at these results broken out by industry sectors, Investing in New Technology was the clear priority for our Software/IT clients, followed by Expanding Sales Teams and Attending Industry Events. Voice of Customer emerged as a clear priority in Business Services. Investing in New Technology dropped lower on the list in Manufacturing and even lower in Healthcare.

Invest in New Technology

Invest in New Technology ranked highest for those clients in the Software/IT market. Solutions being considered or implemented include sales process training tools, CRM systems, and lead management.

“I would rate sales analytics as 4 in importance on the scale of 1 to 5. We have tons of data now, but don’t know which pieces of it are the most relevant.”

Attend Industry Events

Many of our interviewees said they are incorporating trade shows, conferences, and their own hosted events into their sales efforts but will be much more strategic. They have moved away from participating “because everybody else will be there” or “we have always done that show” to a higher focus on revenue generation, relationship building and raising brand awareness. One respondent shared that they see stronger results from hosting targeted, personalized, intimate activities like executive dinners.

Respondents are investing in the events that attract their total addressable market. Therefore, initiatives to better identify and understand target audiences will influence their ability to make the best decisions concerning event participation.

“In the world of social media, industry events are becoming more important because they provide a touch point where you can see a face and shake a hand, and maybe even break bread with your client or prospect.”

Voice of the Customer (VoC) Campaigns

VoC Campaigns include Win/Loss Analysis, CQAs, and Market Research. The intel collected shows respondents are looking to their data to understand the challenges their clients are facing so they can improve offerings and position better against the competition.

“We are going through that right now with our 2022 data and looking at the consulting engagements that we lost and do a loss ratio analysis. We are putting together a formalized and unified process for client feedback and how we gather that, whom we talk to, how we share and report and where we store it because not only is that important for internal viewing from leadership, but also how we follow up with clients and then how we use that from a marketing perspective.”

Respondents are also using VoC campaigns to proactively understand clients’ issues with the services or products they provide and capture Net Promoter Scores (NPS). This intel allows them to act fast to retain clients and tweak Product and Services Roadmaps.

“We’ve started doing pretty heavy NPS-style feedback every six months. What do our clients think of our employees, what do our clients think of the services as a whole? What do our employees think of our clients and so forth?”

You Can Never Know Too Much About Your Clients

Indepth understanding of their unique points of view can:

- Improve retention and minimize churn.

- Influence your go-to-market strategy.

- Impact your product or service roadmap.

- Give you greater insight into the competitive landscape.

- Help you identify new revenue streams.

One participant mentioned that they plan on focusing a great deal of effort to protect their client base, and Voice of the Customer programs are one way they will do that.

“[VoC] is a big piece for us going forward and a large part of what we’re working with a content writer about. Use cases and case studies and things of that nature. More outcomes-based marketing assets. In my experience, when the market goes bad, it’s actually important to get VoC information. You can refine and be more selective in your approach. Now that we are down to a skeleton team, I actually have spent a lot more time on win/loss analysis because when we win, our margins are quite large. So, we made some adjustments here in the last three months which impacted our sales demo cycle which allowed us to get some really quick little wins. Doing that type of analysis helped that, so I think it’s key.”

Expand Inside and Outside Sales Teams

Adding Inside and Outside Sales Team members are areas where respondents are investing. This tactic is not without its challenges including finding the right individuals and retention issues. Many look to firms like ML to fill the gap. However, this response may be skewed given our respondents have all used our services or have considered using our services and are therefore familiar with this service.

“If I were to hire five salespeople next year, I’m going to guess three of them would be in the mid-market which would be our inside sales and then the other two would be outside sales.”

***

“I would do a larger internal sales team to fill up the funnels of the high-end outside salespeople. We’re struggling to find strong outbound salespeople. So inside sales probably would be where I would try to focus on to build them up so that they are the ones that you retain.”

Competitive Research

As highlighted in an earlier example, respondents want to differentiate themselves from the competition and are implementing Competitive Research programs as a starting point. Conducting Win/Loss Analysis interviews is one way to uncover competitive intelligence that is very specific to reasons why a prospect did, or did not, opt to make a purchase.

“A lot of capital has flowed into this space in the last five years. That capital has created more competition. So, a couple of years ago there was a finite number of competitors and you kind of knew which area you staked your space out in and now I’d say that’s different.”

Partner Programs

Our research uncovered two Partner Program strategies. The first involved ML. Perhaps because we have strong relationships with the respondents and have established a position as a trusted advisor, some of them used ML as an example of a partner channel they will continue to use.

“MarketLauncher is a very strong partner providing robust sales and marketing support. Their team is experienced and extremely professional.”

***

“I see MarketLauncher as an extension of our ability to drive early-stage opportunity, so to drive top of funnel. That may be oversimplifying it, but that’s how we worked with you on and off in the last decade or so.”

The second strategy involves leveraging partnerships with companies with complementary products or services. These are non-competitors who have the same total addressable market. We will be watching this trend closely to see how it performs.

“All of our market leaders develop what we call our choice centers of influence, relationships with strategic partners where we have these same kind of ideal client profiles, but we’re not competing with one another. I think a referral network is probably what we’ll keep our people focused on building out.”

Digital Inbound Lead Generation

While several respondents mentioned a desire to improve Inbound Lead Generation, budgeting and resourcing issues are hindering that ability. Instead, they are assigning limited resources to the perceived higher-value strategies noted.

“We don’t do enough of that [digital inbound strategies]. I would say that’s something that’s on our docket to do more next year. We do mostly ABM for enterprise accounts.”

Implement ABM / ABS

Implementing Account Based Marketing (ABM) / Account Based Selling (ABS) initially seems a middle-of-the-pack response because many have existing ABM programs, and most respondents commented that they would continue to invest here. They understand the benefits of focusing on select accounts (whether existing or prospective clients) they feel afford the best opportunity to help them grow revenue.

“We are continuing our already established ABM program… finding those beacons within a very small number of target customers.”

***

“We have been doing this for a fair number of years. We have a decent foothold in the global 2000 accounts. Because of that, we’re doing sometimes million-dollar deals that require a more account-based marketing and sales approach. So, our field salesforce works with our marketing group to be very account based.”

***

“Yeah, I think that there’s tremendous value in ABM initiatives. That’s something that we had just started to do. It’s different for each industry and so if you can find the proper formula for your industry and the people that you’re trying to target, then I think it’s 100% worthwhile.”

Create New Offerings / Explore New Markets

While these last two strategies ranked low, the feedback and high ranking of VoC leads us to believe that Create New Offerings and Explore New Markets are ranking higher than this report shows. They have been included in the responses under Implementing VoC.

“We are fully building out a whole new version of our program. That has not changed. In fact, we have accelerated it to go to market faster. We’re working with several clients to sort of change our product roadmap and accelerate in areas that allow us to be successful with the largest clients.“

Summary

We hope you found these Voice of the Customer insights valuable. We will continue to conduct our interviews and report on the findings. Be sure to follow us on LinkedIn or sign up so you don’t miss our updates. If you are interested in participating in an interview, please reach out to Stephanie Kargel (skargel@marketlauncher.com).

Thank you!